Welcome

Welcome! This section provides answers to the some of the common questions that employers may have about Chapter 13 in the Middle District of Tennessee.

We hope this information is helpful, but please understand that it is only general information. None of the information on this web site is intended as legal advice.

Payroll Deduction Orders in Chapter 13 Cases

Chapter 13 of the Bankruptcy Code provides a way for individuals to obtain debt relief through a voluntary debt reorganization plan approved by the Bankruptcy Court. The trustee in a Chapter 13 case receives payments from the debtor and distributes funds to creditors in accordance with the approved plan.

As part of the process, the Code allows the Bankruptcy Court to order any entity from whom the debtor receives income to pay all or any part of that income to the case trustee. 11 U.S.C. § 1325(c). By withholding pay and timely remitting it to the Trustee, you can help your employee complete the plan and obtain a financial fresh start.

Remitting Payments to the Trustee

How do I make payments to the Trustee?

Most employers simply mail checks to the Trustee. Please include the employee's name and bankruptcy case number to help ensure application to the proper case. This information appears on the payroll deduction order.

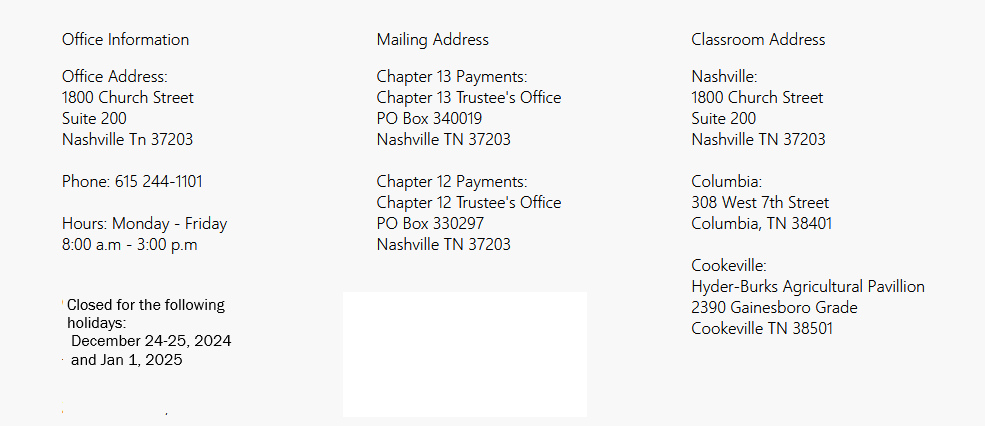

The Trustee's regular payment address is:

Chapter 13 Trustee

P.O. Box 340019

Nashville, TN 37203

The address for delivery by providers other than USPS (such as FedEx or UPS) is:

Chapter 13 Trustee

1800 Church Street

Suite 200

Nashville, TN 37203

The Trustee can also accept electronic payments from employers through the payment-processing service TFS. Please note that TFS is a third-party provider that charges for its service and is not affiliated with the Trustee's Office or the Bankruptcy Court. Information about TFS is available through its web site TFS. If you employ TFS, please be aware of its processing times. The Trustee makes monthly disbursements, so any delays in the receipt of plan payments may affect the Trustee's ability to make disbursements to creditors required by the debtor's plan.

What should I do if I am behind in remitting payments to the Trustee?

Please notify the Trustee immediately and provide information about when to expect the funds. The Payroll Deduction Order is an order from the Bankruptcy Court, so the Trustee does not have any authority to change its requirements. But the Trustee will post all remittances of funds by employers, even if the payments are late, and distribute the funds as soon as practicable.

Do I need the Trustee's Employer Identification Number (EIN)?

A Chapter 13 bankruptcy estate is not treated as a separate entity for tax purposes. See 28 U.S.C.§ 1399. The Trustee, therefore, does not believe employers should need the Trustee's EIN in connection with a payroll deduction order. Payments withheld from an employee's wages that are remitted to the employee's Chapter 13 plan represent the employee's income and should be reported accordingly.

How Much to Pay the Trustee

Please note that the payroll deduction order is an order from the Bankruptcy Court. The Trustee does not have any binding authority to say what it requires. The information here is only guidance about what the Trustee expects to receive, provided for informational purposes only.

Do garnishment limits apply? Why is the payment so much?

The Bankruptcy Code authorizes courts to order withholding of a debtor's income without limit. See 11 U.S.C. § 1325(c). The limits under federal wage garnishment laws do not apply to these orders. See Department of Labor Fact Sheet.

A Chapter 13 plan payment is not the same as a creditor garnishment. A Chapter 13 case is a voluntary proceeding, so the debtor effectively has the power to terminate the payroll deduction order by converting or dismissing the case. And a Chapter 13 plan payment may apply to very different obligations than a creditor garnishment. For example, the plan payment may include an amount to maintain the regular mortgage payment on a debtor's home.

What other amounts should I withhold from the debtor's pay?

The standard payroll deduction order in this district includes a reference to continued withholdings for "taxes, social security, insurance, pension, or union dues." The Trustee, therefore, does not anticipate any termination of these types of withholding.

The standard payroll deduction order, however, does include language prohibiting employers from taking any "deduction on account of any garnishment, wage assignment, child support, alimony payment, credit union, or other purpose not specifically authorized by the Court." The Trustee, therefore, does generally anticipate the termination of these types of withholding.

Withholdings for child support and alimony, however, can be complicated. Sometimes, a debtor's Chapter 13 plan provides for the debtor to continue making these types of support payments, and the debtor may be assuming that you will continue to withhold the payments. The Trustee would encourage you to communicate with the Trustee and the debtor's bankruptcy attorney to help avoid confusion. The parties may be able to request an order from the Bankruptcy Court to clarify the amount you should withhold if necessary.

What if the payment amount on the order is more than the debtor's pay?

The Trustee would not anticipate receiving from the employer any more than the debtor would otherwise be entitled to receive.

What if the payment frequency differs from our payroll frequency?

If the payroll deduction order requires payments on a different frequency than your payroll schedule, please notify the Trustee by phone at 615-244-1101 and send a written communication stating the correct payroll frequency. The Trustee will request a revised order from the Court.

Employee Changes

What should I do if the debtor is on a temporary leave?

If the debtor is on a temporary leave that will interrupt the debtor's income, please notify the Trustee. The Trustee would not anticipate any payment from you if the debtor would not otherwise be entitled to payment.

Employer Changes

What should I do if I change my name, payroll address, or pay frequency?

Please notify the Trustee of any changes that occur while a payroll deduction is active. If your pay frequency changes, the Trustee can request a revised order from the Court to correct the frequency and payment amount.

Resolving Errors

What should I do if I have made an error in a payment to the Trustee or need to stop payment on a check I have sent to the Trustee?

Please contact Julie Matthews, the team leader for the Finance Team in the Trustee's Office, at 615-244-1101 x270. For non-urgent matters, you can email Julie at juliem@ch13bna.com.

What should I do if I am behind in remitting payments to the Trustee?

Please notify the Trustee immediately and provide information about when to expect the funds. The Payroll Deduction Order is an order from the Bankruptcy Court, so the Trustee does not have any authority to change its requirements. But the Trustee will post all remittances of funds by employers, even if the payments are late and distribute the funds as soon as practicable.